Cardinal Migration Overview

As Cardinal migrates into the Global Visa Data Centers and continues to build out our 3DS Server and SDK solutions within the Visa Acceptance Platform, our goal is to support our clients' efforts to make the process for migration straightforward and efficient.

Benefits related to this migration remain unchanged:

- Improved security, performance, and resiliency by maximizing Visa’s global scale and infrastructure

- Additional product features, such as updated reporting capabilities and self-service credential management (generation, rotation, expiration)

- Future product features and enhancements that will be made available through the new and enhanced connectivity

To ensure the ease and simplicity of migration, we recommend following these primary phases of migration:

Phase 1: Migration to API Key Usage. See documentation for instruction.

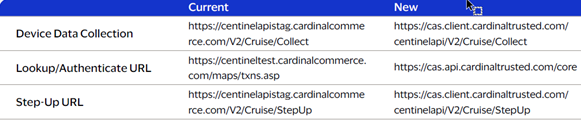

Phase 2 Option B: If you do not update to Cruise API, you will still be required to update all transaction endpoints (see above) as well as:

- All Cruise Hybrid integrations with Songbird will require quarterly integrity hash updates that must be made after migrating. For information on this process please contact your Client Manager or Support.

- Cruise Standard will not be supported within the Visa Acceptance Platform as of December 31, 2025. All merchants using Cruise Standard must update their integration to Cruise API as part of migration.

Phase 3: Plan for rotating Cardinal API keys within 15 months of migration to Visa Acceptance Platform. Further instructions will come guiding you through the process for key rotation.

Phase 4: Set a final date to cutover all traffic to Visa Acceptance Platform.

Within each Phase, Cardinal provides guided steps and technical documentation to take the guess work out of migration.

General Steps for the Migration Process

- Define a rollback strategy with Cardinal teams should something not go as planned.

- Recommendation: Define the new transaction endpoint as “second” or as an additional 3DS provider in configurations to facilitate roll back to legacy endpoints and configuration.

- Implementation will create a ticket with Production Engineering to have the existing Caridnal keys mapped to KMS/Visa keys.

- Clients should make the transaction endpoint change throughout appropriate applications.

- Confirm successful processing of all supported card types in Staging/CAS.

- Where step 3. is successful, confirm the Production transaction endpoint change date/time in collaboration with the Cardinal team.

- Repeat the above steps for Production environment.

- Upon successful Production enablement, Monitoring (Kibana dashboard, Service closure in Dynamics) will be facilitated by the Cardinal team including notifying Support of the customer’s traffic cutover.

- Remember: there are no changes to portal login or reporting experience; still use Cardinal Merchant portal to research and monitor transactions.

FREQUENTLY ASKED QUESTIONS

General Questions

What is the data center migration?

- As a part of Cardinal's ongoing commitment to provide our clients with the highest level of service and availability, Cardinal is migrating our application stack into the Visa Global Data Centers. The migration will provide additional global scale and resiliency and allow Cardinal to modernize our payment solutions through additional security and product features - for our clients both now and in the future.

When will clients need to migrate?

- All clients are asked to begin migration now. By June 30, 2025, the goal is to have all clients’ authentication traffic moved to the Visa Acceptance Platform.

What is involved with the data center migration?

- There are 3 – 4 primary steps depending on how you’ve integrated with Cardinal.

- Phase 1: Migration to API Key Usage. If not already done, see documentation for instruction.

- Phase 2 Option A: Update your integration to Cruise API

- Phase 3: Plan for rotating Cardinal API keys within 15 months of migration to Visa Acceptance Platform.

- Phase 4: Set a final date to cutover all traffic to Visa Acceptance Platform.

Am I able to have any custom integrations as part of the migration process?

- We will not be supporting custom implementations as part of migration. The recommended URLs should be used with the goal of avoiding any non-standard implementations for better supportability.

Who do I contact to begin migration?

- Please speak with your Client Success or Account Manager. Or call +1.877.352.8444 or email support@cardinalcommerce.com

Technical Questions

What should I do if I still use legacy PID/MID/TxnPwd?

- An upgrade is required. For updating your credentials to the API key signature reach out to your CSM or find instructions here Updating to Signature.

What do I need to test in staging?

- Run 3 transactions for each card brand: AMEX, CB, Discover, Eftpos, Elo, ITMX, JCB, mada, MasterCard, UnionPay, Visa

How do I know if my pilot in staging or CAS is successful?

- Cardinal will be monitoring all test transactions and will provide reports.

Can I load tests in staging with this new endpoint

- No. All performance or load testing must be coordinated with the Cardinal team on clear definitions of load, duration, and date.

What is the recommended failover or rollback process?

- Cardinal recommends that the migrator create a new Cardinal setup (provider) with route intelligence for the new endpoint URL so that if an issue occurs the traffic can be switched back to the Cardinal setup with the legacy integration.

Once I've successfully run test transactions in staging, can I move/promote my endpoint to Production?

- Yes, you can promote your endpoint to Production. Prior to moving to Production, please contact Cardinal to coordinate and to ensure all Production preparation are done. We will monitor your production transactions as well ensuring success.

Post migration, will there still be the ability to load test prior to holiday and peek seasons?

- Since we will be part of Visa Data Center, Visa has stringent standards to ensure we are elastic and can handle peak seasons or unexpected volume increases with no degradation is service level. This includes monitoring/alerting to proactively identify any health issues. Load testing will not be available in the short term.

Where can I access my transaction reports?

- Transaction reports can be viewed in the migrator's Merchant Portal.

What error can I expect to see if the customer's OrgUnitId and associated keys haven't been properly migrated to Visa?

- If the key mapping jMeter in SSO has not been completed successfully and the customer attempts to connect to Visa/CGK endpoints, they will see the following error response from Cardinal:

<ErrorDesc>Error Processing Lookup Request Message, The API Key used to sign the request is disabled.</ErrorDesc><ErrorNo>1002, 3030</ErrorNo>